How does GDP impact housing? We make it easy to understand how the world works. And, we summarize what is going on in Western Washington today.

Continue reading “State of the Market—2nd Quarter 2018 by Jen Hudson”

How does GDP impact housing? We make it easy to understand how the world works. And, we summarize what is going on in Western Washington today.

Continue reading “State of the Market—2nd Quarter 2018 by Jen Hudson”

There is no such thing as a “no-cost” loan. But these options may help.

Let me translate the title for our younger crowd… #RaiseTheBar… of your financial fitness, that is.

We recently posted an article about Humans versus Robots. If you missed it, you can read it here.

Following this, we received a very kind note from our good friend and longtime lender, Tom Lasswell.

Tom was gracious enough to expand on our story and pointed out some things that bare repeating.

“I appreciated reading your most recent report…. Technology and how that is impacting Real Estate and Lending…

Too many financial disciplines are needed to work together for an individual or family to even have a basic strategy, let alone a great one. With so many variables for any individual or family, many of the attorneys, financial advisors, CPAs, and Bankers don’t even understand how their service area impacts another, and vice versa.”

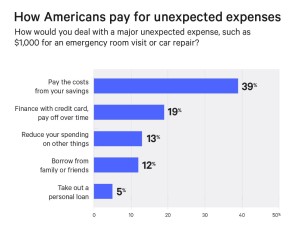

Based on a recent report published by CNBC (and released by Bankrate), only 39% of Americans could cover an unexpected $1000 emergency from their own funds. In case you are doing the math, that translates to 61% of Americans do not have enough cash or money in the bank to pay a $1000 emergency.

That. Is. Scary. Especially when most emergencies cost a lot more than $1000… at least from what I have seen.

That. Is. Scary. Especially when most emergencies cost a lot more than $1000… at least from what I have seen.

He continues with “the industries have dumbed down their disciplines to compete. Yet what I see today is Sales people Selling and Telling, when they should be Caring and Consulting. Many do not have the education and expertise to truly guide their clients in the best manner possible.”

Is it in anyone’s best interest for us to sit back and ignore the problems that these automated and “streamlined” systems are creating? I don’t think so. Where has common sense gone?

Tom states “there are approximately 216 combinations of residential mortgage and insurance strategies.”

That is a lot of combinations for a single mortgage or insurance or financial advisor to understand. But, isn’t that their job? Shouldn’t you be able to have a qualified professional discuss the pros and cons with you personally based on your unique situation? Yes, it takes work to understand all those details and be able to educate someone on them. But…. That is what I thought a professional was!

With this ongoing shift in our world to a more automated and “intuitive” system, we need to be careful. If most loan advisors do not really understand how rates work, then how can you expect them to guide the technology company to create a program that works in their client’s best interest?

Next time you run into a “professional”… or professional hack, that is… ask them what is the difference between a stock and a bond? Or, the difference between an annuity or life insurance policy? How about the difference between a will and a trust? Careful though, all of these questions will also require you to then ask your CPAs how all the tax implications work. I hope you have a good CPA too!

Tom warns us that we need to be aware of entire industries that are trying so hard to compete on price, that they have overlooked value completely. If you are working with a professional who lacks the understanding behind their industry and service, then maybe you should keep searching for a real professional instead. If you have questions, the answer should NEVER be “let’s not discuss too many options, as that elicits too many questions and crates too many headaches for our company.” Of course, they don’t state that directly… but you get the feeling a lot of times that is what they want to say, right?

When you need a real professional for your lending needs, you should give our friend Tom Lasswell with New American Funding a call at (206) 817-5532. He’s been in the business for 35 years and knows more than just a thing or two.

And, when you want a team of professionals who truly understand the real estate market and all the related and moving components, you can reach us directly any day except Sunday.

Duane Petzoldt (425) 239-1780 or duane@hudsoncreg.com

Jen Hudson (206) 293-1005 or jen@hudsoncreg.com

Your life decisions shouldn’t be made by a robot, and certainly not a robot that is still in the beta phase. Let’s all come together and force these companies to raise the bar when it comes to their automated technology and how they train the people who are supposed to be helping you.

Cheers!

Jen Hudson & Duane Petzoldt

Let’s talk about the elephant in the room. You know, the one where robots take over the jobs of humans. Today, let’s talk about the jobs in real estate and lending.

Or, to be more specific, the disruption that is forcing changes across the industry.

Hold on, that sounds technical.

It is, but not really. Let’s use common sense.

Disruption: A radical change in an industry or business strategy, especially involving the introduction of a new product or service that creates a new market.

Disruption is also known as “forget about the old way of doing things, it no longer exists”. This new way involves something faster and automated, which typically means cheaper. But remember, as everyone races to the bottom with their giant Amazon companies, the floor doesn’t stop at zero. There are negative numbers too, meaning many companies are losing money with the hope that one day they grab enough low-paying customers to compensate for the overhead.

Do you want another scary realization? The next time you sign up for something that is “free”… if you aren’t the paying customer, then that means you are the product being sold. Yup. Welcome to technology.

Editors Note: We don’t sell your name or data, even though this is free. Thanks for reading. Cheers!

Both the real estate and lending industry have been ripe for disruption for decades. We’ve talked about it for years, but it is happening before our eyes. Today.

In a lot of ways, I’m super excited about the new innovations that are coming to light. In other ways, it scares the bejesus out of me for the consumers who just don’t know any better and don’t enough know enough to ask.

Before we dive into what robots and artificial intelligence are doing, let’s look at where companies are heading with their business models.

Before we dive into what robots and artificial intelligence are doing, let’s look at where companies are heading with their business models.

There have been countless news stories and opinion columnists citing statistics and reports on start-ups poised to shake things up. Admittedly, the numbers are impressive. Investor funding runs well into nine figures for the two largest direct homebuyers, Opendoor ($320 million) and OfferPad ($260 million).

As entrepreneurs and investors have continued to gravitate towards the various opportunities offered within real estate, the Real Estate Tech ecosystem has grown in both size and scope. Since 2012, Real Estate Tech companies have received over $6 billion in funding, with companies raising $2.6 billion in venture capital in 2016 alone, a substantial increase from the $1.9 billion reported in 2015. With over 100 real estate focused startups receiving early stage funding in 2016 and later stage tech enabled real estate companies like Compass (raised $450 million in early December 2017) and Redfin ($138 million IPO in July 2017) raising substantial amounts of capital, the sector has undoubtedly piqued the interest of consumers, investors, and industry players alike. Not to mention Zillow.

What are these companies doing that makes investors so excited they are willing to pump in hundreds of millions of dollars into them? They are creating mega-tech one-stop-shop companies that are meant to take over your life.

First up, let us look at Rocket Mortgage.

I’m sure you have heard of Rocket Mortgage by now. Rocket Mortgage is owned by Quicken Loans, and had it’s coming out party during the 2016 Super Bowl Ads. According to housing wire, Quicken Loans was #1 in 2017 by transaction volume and looks to be heading to the number #1 spot for 2018 as well. Quicken did have true innovation when it comes to Rocket Mortgage, and they were rewarded with the top spot in the country for lenders by both the highest number of transactions and largest volume of mortgages.

(Full disclosure: I’m not a Quicken Loan fan, but I can still respect some of the technology they have created and implemented into their company.)

So, what did Quicken Loans do that is different than many lenders? A couple things.

Hey, that’s just one company. You can’t use one company as an example of where the whole industry is heading!

That’s true.

Let’s look at the nation’s number two lender. LoanDepot. LoanDepot launched mello Home earlier this year, which is a service that connects buyer clients to their agents. Sounds like another “one stop shop” approach, like Amazon. And, it is. I won’t make you sit through the list twice, but it’s pretty much the same thing with a variety of separate companies all brought together under one roof.

What about number 3, 4, 5, etc? Yup. They are all attempting to create a one-stop-shop for services with the hope of having you spend less time shopping services between companies and more time just writing them one big fat check instead of a bunch of small ones.

Ok, so what about robots and artificial intelligence taking over human jobs? Should traditional brokerages feel threatened? Maybe. But, probably not.

While these technological advances are meant to eliminate the human element, humans are still necessary in a lot of ways. Elon Musk (PayPal, Space-X, Tesla, SolarCity, and The Boring Company) will tell you that humans are underrated and that he brought people back into Tesla to help smooth the process and speed things back up in his production line. His robots got too unwieldy and slowed things down!

So if robots alone are too cumbersome and humans alone are too slow, what is the answer?

A human-machine symbiosis. That is what we should be talking about. Creating robots to enhance human services, not to replace them.

I’m sure you have heard the opinion that real estate agents and lenders will soon be replaced by technology. However, I tend to think that the agent-centric model has staying power, though it will look a bit different in the future.

In my opinion, the new technology (whether you mean software, applications, block-chain, robots, etc) should work to accelerate the closing process and smooth out some of the hurdles. Loans could become faster. Property information may be easier to find. Title issues could be quicker to address or monitor. But at the end of the day, it still involves people.

While this massive collection of data and introduction of search portals has increased the amount of information available and speed to get to it, it has not provided anyone with the context necessary to make a decision. Media company models focus on optimizing for page-views and clicks, yet fail to support crucial channels of information exchange between agents and clients. This is proven by the increased demand for agents over the last two decades even with the introduction of platforms such as Trulia and Zillow.

Why do I think that real estate and lending professionals will remain essential?

Simply because humans are better at some things than robots.

For example:

Given these observations, I believe that a successful real estate platform will augment agents with data and tools to accelerate their business and serve their clients better.

Some areas where I hope to see great improvements are:

While the technology to find data or accomplish transactions has improved, the basis for decision making or in-depth understanding about the process has not progressed forward, and in many ways I feel it is taking leaps backwards. Maybe there will be a change in direction and people will begin to expect a higher level of competency with all this technology we are creating. The data is there. We just need to teach people how to use it!

Moving forward, let’s focus on integrating humans and robots, not replacing humans with robots.

If we are going to see any real advances in real estate technology, it will be to improve the agents or lenders ability to educate their clients by interpreting and telling stories with data. Buyers and Sellers will want someone who can tell narratives about past work in a neighborhood, draw attention to unusual features of a property, and help frame the price of a new home in terms of financial and demographic trends. Real estate agents and lenders with sophisticated tools will likely perform these functions better than automated brokerages for decades to come, but it takes work. Don’t forget that on the other side of that post is a real live person. Be nice.

In the words of Elon Musk (ok, it was a tweet), “Humans Are Underrated”. Finding applications that help humans become more efficient is a better bet than creating applications to replace humans completely. In real estate and lending, there will always be a demand for humans who are experts in their field and provide consumers with more meaningful experiences.

Need help getting started? We are happy to point you in the right direction with data that can be trusted and help you make connections with the people you need to know.

Jen Hudson | (206) 293-1005 | jen@hudsoncreg.com

Duane Petzoldt | (425) 239-1780 | duane@hudsoncreg.com