I’ll take “What is REET” for $400 please.

The REET is the Real Estate Excise Tax. Think of it like sales tax when you sell your property.

Washington State has (2019 and prior) a flat excise tax of 1.28% across the state. In addition to this 1.28%, individual jurisdictions such as cities or counties can levy an extra 0.50%, for a total of $1.78%.

For example, almost everywhere in Snohomish, King, Skagit, or Whatcom county is a tax of 1.78% total. The exceptions here are Darrington and Skykomish, at a total of 1.53% instead. There are others throughout the state, those are just the ones we work most frequently with.

That means, if you want to sell your home, in most areas you will pay a total excise tax of 1.78% at closing to the Department of Revenue.

Right now, it does not matter if your property is worth $300,000 or $3,000,000, your excise tax is the same rate at 1.78%.

Is the REET going to change?

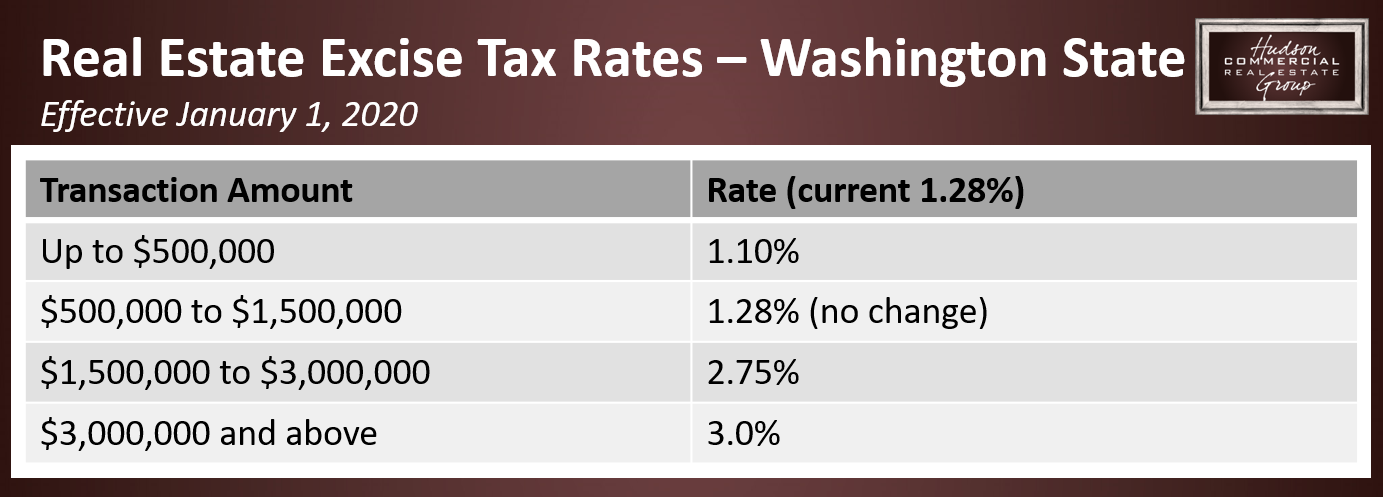

Yes. Starting January 1, 2020, the real estate excise tax rate across Washington State is going to change.

The good news?

Home and property owners with sales prices at $1,500,000 or below will see either no change or a reduction in this rate. Properties valued below $500,000 will see a reduction of 14% from 1.28% down to 1.10%. The properties between $500,000 and $1,500,000 will remain the same.

The bad news?

Property owners with sales prices above $1.5mil will see their taxes more than double, with rates at 2.75% for $1,500,000 – $3,000,000 and 3.0% for $3,000,000 and above.

How does the new REET work?

This new REET system is going to be a graduated or tiered structure. While the lower end of the market will benefit from these new rates, the middle stays the same, and upper end will owe more in taxes at closing.

New REET Rates for Washington State (State only, local jurisdiction is extra)

REET Price Example – $350,000:

For example, if you sold a property for $350,000 in Everett, you would pay $6,230 today (1.28% plus 0.50% = 1.78%).

If you sold that same property in 2020, your tax is now $5,600 (1.10% plus 0.50% = 1.60%), which is a $630 savings.

REET Price Example – $2,500,000:

The other end of the spectrum looks a little different. Let’s say your property is worth $2.5mil. Today, your tax is $44,500 (1.28% plus 0.50% = 1.78%).

In 2020, those same taxes will increase to $58,300 ($8,000 + $17,800 + $32,500), which is an additional $13,800 cost.

1st tier $500,000 of sales price x (1.10% + 0.5% = 1.6%) = $8,000

2nd tier $1,000,000 of sales price from $500k-$1.5mil x (1.28% + 0.5% = 1.78%) = $17,800

3rd tier $1,000,000 of sales price from $1.5mil-$2.5mil x (2.75% + 0.5% = 3.25%) = $32,500

Is there anything else I should know?

Keep in mind these rate changes are to the state portion of the real estate excise tax, not the local city or county jurisdiction.

If you live in a location such as Everett or Arlington where you currently pay 1.28% to the state plus 0.50% to the local jurisdiction, then you will still pay your state fee between 1.10-3.0% (in the chart above) plus the extra local percentage on top of that.

One more thing.

While a 1031 tax deferred exchange is usually a great weapon to combat your tax bill, unfortunately it won’t work here. In Washington State, the excise tax is due on the sale of your property to the state and local jurisdiction, and is not one of the taxes that can be deferred later, such as capital gains or the recapture tax on depreciation.

As Sun Tzu says “Strategy without Tactics is the slowest route to victory. Tactics without Strategy is the noise before defeat.” We excel at helping you plan and prepare, to make sure you get to the finish line in the best way possible.

For more information about local tax rates or to talk strategy, give us a call at (206) 466-4020 or send an email to info@hudsoncreg.com.

Cheers!

Jen Hudson & Duane Petzoldt