How does GDP impact housing? We make it easy to understand how the world works. And, we summarize what is going on in Western Washington today.

Continue reading “State of the Market—2nd Quarter 2018 by Jen Hudson”

How does GDP impact housing? We make it easy to understand how the world works. And, we summarize what is going on in Western Washington today.

Continue reading “State of the Market—2nd Quarter 2018 by Jen Hudson”

Let me translate the title for our younger crowd… #RaiseTheBar… of your financial fitness, that is.

We recently posted an article about Humans versus Robots. If you missed it, you can read it here.

Following this, we received a very kind note from our good friend and longtime lender, Tom Lasswell.

Tom was gracious enough to expand on our story and pointed out some things that bare repeating.

“I appreciated reading your most recent report…. Technology and how that is impacting Real Estate and Lending…

Too many financial disciplines are needed to work together for an individual or family to even have a basic strategy, let alone a great one. With so many variables for any individual or family, many of the attorneys, financial advisors, CPAs, and Bankers don’t even understand how their service area impacts another, and vice versa.”

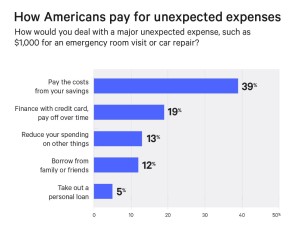

Based on a recent report published by CNBC (and released by Bankrate), only 39% of Americans could cover an unexpected $1000 emergency from their own funds. In case you are doing the math, that translates to 61% of Americans do not have enough cash or money in the bank to pay a $1000 emergency.

That. Is. Scary. Especially when most emergencies cost a lot more than $1000… at least from what I have seen.

That. Is. Scary. Especially when most emergencies cost a lot more than $1000… at least from what I have seen.

He continues with “the industries have dumbed down their disciplines to compete. Yet what I see today is Sales people Selling and Telling, when they should be Caring and Consulting. Many do not have the education and expertise to truly guide their clients in the best manner possible.”

Is it in anyone’s best interest for us to sit back and ignore the problems that these automated and “streamlined” systems are creating? I don’t think so. Where has common sense gone?

Tom states “there are approximately 216 combinations of residential mortgage and insurance strategies.”

That is a lot of combinations for a single mortgage or insurance or financial advisor to understand. But, isn’t that their job? Shouldn’t you be able to have a qualified professional discuss the pros and cons with you personally based on your unique situation? Yes, it takes work to understand all those details and be able to educate someone on them. But…. That is what I thought a professional was!

With this ongoing shift in our world to a more automated and “intuitive” system, we need to be careful. If most loan advisors do not really understand how rates work, then how can you expect them to guide the technology company to create a program that works in their client’s best interest?

Next time you run into a “professional”… or professional hack, that is… ask them what is the difference between a stock and a bond? Or, the difference between an annuity or life insurance policy? How about the difference between a will and a trust? Careful though, all of these questions will also require you to then ask your CPAs how all the tax implications work. I hope you have a good CPA too!

Tom warns us that we need to be aware of entire industries that are trying so hard to compete on price, that they have overlooked value completely. If you are working with a professional who lacks the understanding behind their industry and service, then maybe you should keep searching for a real professional instead. If you have questions, the answer should NEVER be “let’s not discuss too many options, as that elicits too many questions and crates too many headaches for our company.” Of course, they don’t state that directly… but you get the feeling a lot of times that is what they want to say, right?

When you need a real professional for your lending needs, you should give our friend Tom Lasswell with New American Funding a call at (206) 817-5532. He’s been in the business for 35 years and knows more than just a thing or two.

And, when you want a team of professionals who truly understand the real estate market and all the related and moving components, you can reach us directly any day except Sunday.

Duane Petzoldt (425) 239-1780 or duane@hudsoncreg.com

Jen Hudson (206) 293-1005 or jen@hudsoncreg.com

Your life decisions shouldn’t be made by a robot, and certainly not a robot that is still in the beta phase. Let’s all come together and force these companies to raise the bar when it comes to their automated technology and how they train the people who are supposed to be helping you.

Cheers!

Jen Hudson & Duane Petzoldt

We believe that the housing market is a lot more than just homes. This graphic (below) is oversimplified, but just think about all the interlocking pieces involved for our world to function.

Now with this big picture view in mind, let’s talk about what is going on in Washington State today.

Now with this big picture view in mind, let’s talk about what is going on in Washington State today.

The Washington State economy added 96,900 new jobs over the past 12 months, representing an annual growth rate of 2.9%—still solidly above the national rate of 1.5%. Most of the employment gains were in the private sector, which rose by 3.4%. The public sector saw a more modest increase of 1.6%.

The strongest growth was in the Education & Health Services and Retail sectors, which added 17,300 and 16,700 jobs, respectively. The Construction sector added 10,900 new positions over the past 12 months. 10,900 jobs in Construction is a start, but let’s face it… we need a lot more than that to catch up with our housing demands.

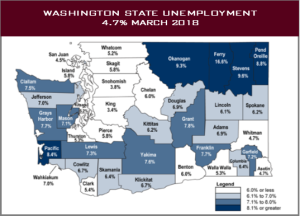

Even with this solid increase in jobs, the state unemployment rate held steady at 4.7%—a figure that has not moved since September of last year. Remember, the unemployment rate only counts people who are looking for jobs in the workforce, not people who can’t work or who are sitting on the sidelines.

We expect the Washington State economy to continue adding jobs in 2018, but not at the same rate as last year. Why? A couple reasons. One, employers only hire as many people as they need to run a company. If employers are already fully staffed, then their business demands need to increase before making new jobs. Plus, you can’t have new jobs without people. If people are not able to work, or choose not to work, then you can’t hire them. It’s that simple. That said, we will still outperform the nation as a whole when it comes to job creation, as we have a lot of stable and “needs-based” industries here, such as Health Care, Aerospace, Education, and Transportation.

Where did we lose jobs? Manufacturing. Our Manufacturing sector has lost 5,700 jobs this past year, with another loss of 3,300 projected.

Where else are we paying attention? Aerospace. There is some concern that President Trump’s steel and aluminum tariffs could hurt manufacturers such as Boeing. While much of Boeing’s material is sourced domestically, many of their orders come from China. If China decides to retaliate, they could easily shift their orders over to Airbus, which would hurt our local economy. On a good note, there is a growing demand for cargo planes, which means the 767 line in Everett is expected to increase, along with 737s and 787s.

This increase in cargo planes also supports what we are seeing down in the Ports. The container volume (you know, the giant metal containers that go from ships to trains to trucks to stores) was up 6% in February, and our breakbulk volume (meaning things that need to be loaded individually, like oil in containers or apples in crates) was up almost 30%. The one shipment that has been down consistently? Auto volume, which was down 8% in February.

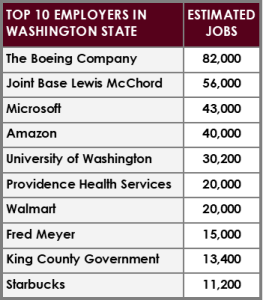

What other major companies drive our local economy besides Boeing and the Ports?

Amazon. They currently have 8.1 million square feet of office space, which is expected to soar to 12 million square feet within the next 5 years. Amazon’s search for H2 has concerns for slowed hiring locally, but regardless they are still one of our heavy hitters when it comes to employment. Microsoft is also talking about expanding their Redmond Campus, which means ultimately renovating 6.7 million square feet and building another 2.5 million square feet by the end of 2020. Other major drivers in our local economy for office space are a mix of both old and new tech companies, including Cisco, Apple, eBay, AirBNB, Uber, Snap, Alibaba, Tableau, Valve, and Wave Broadband.

Amazon. They currently have 8.1 million square feet of office space, which is expected to soar to 12 million square feet within the next 5 years. Amazon’s search for H2 has concerns for slowed hiring locally, but regardless they are still one of our heavy hitters when it comes to employment. Microsoft is also talking about expanding their Redmond Campus, which means ultimately renovating 6.7 million square feet and building another 2.5 million square feet by the end of 2020. Other major drivers in our local economy for office space are a mix of both old and new tech companies, including Cisco, Apple, eBay, AirBNB, Uber, Snap, Alibaba, Tableau, Valve, and Wave Broadband.

On the slower side we have retailers. We are going to lose some major stores this year both locally and nationally due to closures, including Macy’s, Sears, Kmart, Toys R Us, and Babies R Us. Despite this, there are still new retail stores and centers under construction, with others moving toward more of a mixed-use design.

Home Sales Activity: Western Washington

Annual Changes in Home Prices: Western Washington

While the housing market is great today, please keep in mind that everything cycles. Will home values drop tomorrow? Probably not. Keep an eye on interest rates and your timing in the market if you want to make any moves in the future. Need help trying to predict the future? Give us a call or email to stay ahead of the trends.

Jen Hudson (206) 293-1005 and Duane Petzoldt (425) 239-1780

Note: The names have not been changed, as neither party is innocent.

Terry and Diane Visser lived in Blaine, Washington and had a habit of buying homes as investment properties. They bought one of these “fixer-uppers” as an investment back in 2005.

After acquiring the property and beginning their renovations, they realized Continue reading “An Obvious Defense, Overlooked By Many. By Jen Hudson”

You’re telling me there is a chance that the buyer pays the seller’s taxes??? How is that??? Continue reading “A Crazy Little Thing Called… FIRPTA. By Jen Hudson”

Here’s a fun game.

You know how you hear people talking about increasing rental rates and then include numbers like 5% annual increases? See, funny thing. There is a lot more to that story than meets the eye. Continue reading “Myth Busters. Myth Buyers is More Like It! By Jen Hudson”

Investment real estate is one of the oldest and most inefficient Continue reading ““Be Strong”… I whispered to my wifi signal. by Jen Hudson”

A question I hear frequently is “why do I need title insurance?”

Well… as they say at the Big Thunder Mountain Railroad in Disneyland.. Hold onto your hats and glasses folks! Continue reading “What is the Point of Title Insurance? By Jen Hudson”