THIS ILLUSION IS ITS OWN MAGIC TRICK. NOW YOU SEE IT. NOW YOU DON’T!

Meet Jack. Jack is an investor. He has been doing this a while. He likes rental properties and has a lot of them. He has had some homes for more than 30 years! Jack’s homes are in good condition. They are older properties, but the rent is good. Let’s take a look at an example of what he is paying his taxes on. (Psst… Don’t let your eyes gloss over when you hear taxes. It’s actually pretty simple and puts more money in your pocket. I’ll show you how.)

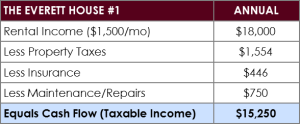

Let’s call the first property Jack’s Everett House #1. He paid $32,000 in 1982 for it. Today, it is worth around $250,000.

Seems like a nice little rental house, right? What if Jack completed a 1031 exchange and just swapped it for a similar property, but at today’s market value?

You might be thinking to yourself… why in the world would I get rid of the property I paid $32,000 for, just to buy the same property for $250,000? That doesn’t sound like it makes sense at all!

In a lot of ways, I do agree with you. It can be silly to pay more for the same thing you own.

But…. watch what happens when the tax part comes in.

Jack had the Everett House #1 for 30 years. Originally, when he purchased Everett House #1, he was able to depreciate that property. However, Jack has had it so long, that now he does not have any depreciation left.

Jen, what is this magical depreciation you talk about? It’s simple really. As things like sticks and bricks get older, they wear out or lose their “useful life.”

Depreciation is an IRS thing. On paper, it is an imaginary expense you get to write off each year as a property owner. You only get to depreciate your investment properties; you can’t do it on your home. What are the rules, you ask? I mean, we are dealing with The IRS Tax Code, so of course there are rules.

Rule #1. You only get to depreciate the value of the improvements (means the house or garage… you know, the sticks and bricks) and not the land.

Rule #2. Residential properties (which means between 1-4 units) are depreciated over 27.5 years. Commercial properties (means 5+ units, or office, retail, warehouses, etc) are depreciated over 40 years.

Why is a residential property depreciated over 27.5 years and a commercial property depreciated over 40 years? Honestly, I have no idea. That is how long the IRS decided that type of property is “good for”, so just go with it.

Now, let’s go back and look at Jack’s scenario.

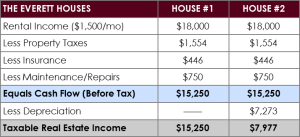

Jack purchased EVERETT HOUSE #2 for $250,000. Let’s say that 80% of the value is in the improvements and 20% of the value is in the land. In this case, that is $200,000 for the sticks and bricks, with $50,000 value left on the dirt.

Remember, we do not get to depreciate the dirt. We only depreciate the structure and improvements that eventually need to be replaced.

To do this, we take the $200,000 in improvements and amortize (or divide) that over 27.5 years. That equals $7,273 each year in depreciation.

![]()

That’s great Jen, but really… why do I care again? If you were Jack, you should care a lot. Instead of paying taxes on rental income of $15,250, he only has to pay taxes on rental income of $7,977 for that very same property! Let’s take a look…

Did his rental income change? No. Did his actual cash flow stream from the rents or expenses change? No. Did his property’s value or his equity change? No. Did his tax bill go down? Yes!

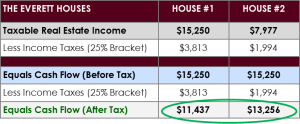

Not to point out the obvious, but let’s take this one step further. Pretend for a moment that Jack is in the 25% tax bracket for his income taxes with the IRS.

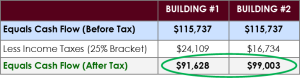

Using the numbers here, you can see how this turns quickly into additional cash in his pocket!

Simply by depreciating his property, Jack is able to keep an additional $1,819 in his pocket at the end of  the year.

the year.

![]()

That is a 48% savings off his original tax bill!

Imagine if Jack had 10 properties in a similar situation. He would save $18,190 in extra income he doesn’t pay to the IRS, or potentially even more!

Ok, but what if you haven’t had your property for 30 years like Jack?

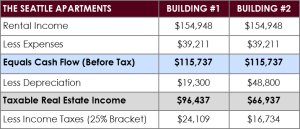

Meet Jill. Jill bought a 9 unit apartment in Seattle in 1994 for $965,000. She has been proactive in keeping the building nice and raising rents. It’s not fancy, but it’s clean. Between her attentive management and the robust Seattle market, Jill’s property is worth $2.44 million today. I will not bore you with the detail, so here are her numbers on the property.

Remember, Jill still has depreciation remaining on her building.

QUICK TIP: Building #1 is based on $965,000 and Building #2 is based on the new value of $2.44 million. Improvements are estimated at 80% of purchase amortized over 40 years.

EX1: $965,000 x 80%  =$772,000 $772,000 / 40 years = $19,300/yr

=$772,000 $772,000 / 40 years = $19,300/yr

EX2: $2,440,000 x 80% = $1,952,000 $1,952,000 / 40 years = $48,800/yr

Another point to keep in mind Nothing is free. There are costs associated with real estate.

How long will it take you to recoup the costs associated with a sale and purchase, compared to the savings that you may get with a new property? With the assistance of a 1031 exchange, you may be able to defer the taxes on the sale of your “old” relinquished investment property until later, so that is a huge savings. I mean, we all have to pay taxes eventually, but later is typically better than today.

On another note unrelated to taxes, keep in mind that expenses matter too.

If you are going to swap properties, does it make sense to move-up too and buy something that has better rents than you are currently getting? Maybe you should look for something that is a little nicer condition so you will have less expenses toward repairs in the coming years.

This is the fun part! When you’re ready to take a look at options, let me know and I’ll tell you if it is even worth your time. You can find me any day except Sunday. Call or text (206) 293-1005 or email: Jen@HudsonCREG.com. ![]()

Market Intelligence Matters.