There is no such thing as a “no-cost” loan. But these options may help.

It’s Time to Raise the Bar. by Jen Hudson

Let me translate the title for our younger crowd… #RaiseTheBar… of your financial fitness, that is.

We recently posted an article about Humans versus Robots. If you missed it, you can read it here.

Following this, we received a very kind note from our good friend and longtime lender, Tom Lasswell.

Tom was gracious enough to expand on our story and pointed out some things that bare repeating.

“I appreciated reading your most recent report…. Technology and how that is impacting Real Estate and Lending…

Too many financial disciplines are needed to work together for an individual or family to even have a basic strategy, let alone a great one. With so many variables for any individual or family, many of the attorneys, financial advisors, CPAs, and Bankers don’t even understand how their service area impacts another, and vice versa.”

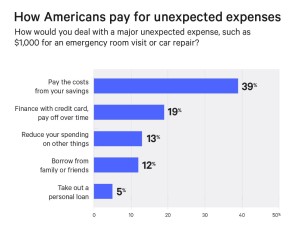

Based on a recent report published by CNBC (and released by Bankrate), only 39% of Americans could cover an unexpected $1000 emergency from their own funds. In case you are doing the math, that translates to 61% of Americans do not have enough cash or money in the bank to pay a $1000 emergency.

That. Is. Scary. Especially when most emergencies cost a lot more than $1000… at least from what I have seen.

That. Is. Scary. Especially when most emergencies cost a lot more than $1000… at least from what I have seen.

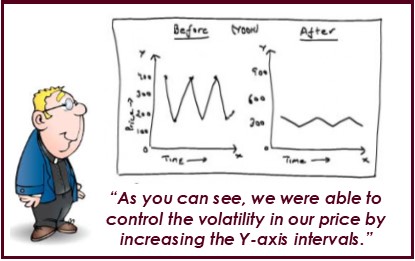

He continues with “the industries have dumbed down their disciplines to compete. Yet what I see today is Sales people Selling and Telling, when they should be Caring and Consulting. Many do not have the education and expertise to truly guide their clients in the best manner possible.”

Is it in anyone’s best interest for us to sit back and ignore the problems that these automated and “streamlined” systems are creating? I don’t think so. Where has common sense gone?

Tom states “there are approximately 216 combinations of residential mortgage and insurance strategies.”

That is a lot of combinations for a single mortgage or insurance or financial advisor to understand. But, isn’t that their job? Shouldn’t you be able to have a qualified professional discuss the pros and cons with you personally based on your unique situation? Yes, it takes work to understand all those details and be able to educate someone on them. But…. That is what I thought a professional was!

With this ongoing shift in our world to a more automated and “intuitive” system, we need to be careful. If most loan advisors do not really understand how rates work, then how can you expect them to guide the technology company to create a program that works in their client’s best interest?

Next time you run into a “professional”… or professional hack, that is… ask them what is the difference between a stock and a bond? Or, the difference between an annuity or life insurance policy? How about the difference between a will and a trust? Careful though, all of these questions will also require you to then ask your CPAs how all the tax implications work. I hope you have a good CPA too!

Tom warns us that we need to be aware of entire industries that are trying so hard to compete on price, that they have overlooked value completely. If you are working with a professional who lacks the understanding behind their industry and service, then maybe you should keep searching for a real professional instead. If you have questions, the answer should NEVER be “let’s not discuss too many options, as that elicits too many questions and crates too many headaches for our company.” Of course, they don’t state that directly… but you get the feeling a lot of times that is what they want to say, right?

When you need a real professional for your lending needs, you should give our friend Tom Lasswell with New American Funding a call at (206) 817-5532. He’s been in the business for 35 years and knows more than just a thing or two.

And, when you want a team of professionals who truly understand the real estate market and all the related and moving components, you can reach us directly any day except Sunday.

Duane Petzoldt (425) 239-1780 or duane@hudsoncreg.com

Jen Hudson (206) 293-1005 or jen@hudsoncreg.com

Your life decisions shouldn’t be made by a robot, and certainly not a robot that is still in the beta phase. Let’s all come together and force these companies to raise the bar when it comes to their automated technology and how they train the people who are supposed to be helping you.

Cheers!

Jen Hudson & Duane Petzoldt

Humans Are Underrated. by Jen Hudson

How Technology Needs A Better Approach For Sustainable Success.

Let’s talk about the elephant in the room. You know, the one where robots take over the jobs of humans. Today, let’s talk about the jobs in real estate and lending.

Or, to be more specific, the disruption that is forcing changes across the industry.

Hold on, that sounds technical.

It is, but not really. Let’s use common sense.

Disruption: A radical change in an industry or business strategy, especially involving the introduction of a new product or service that creates a new market.

Disruption is also known as “forget about the old way of doing things, it no longer exists”. This new way involves something faster and automated, which typically means cheaper. But remember, as everyone races to the bottom with their giant Amazon companies, the floor doesn’t stop at zero. There are negative numbers too, meaning many companies are losing money with the hope that one day they grab enough low-paying customers to compensate for the overhead.

Do you want another scary realization? The next time you sign up for something that is “free”… if you aren’t the paying customer, then that means you are the product being sold. Yup. Welcome to technology.

Editors Note: We don’t sell your name or data, even though this is free. Thanks for reading. Cheers!

Both the real estate and lending industry have been ripe for disruption for decades. We’ve talked about it for years, but it is happening before our eyes. Today.

In a lot of ways, I’m super excited about the new innovations that are coming to light. In other ways, it scares the bejesus out of me for the consumers who just don’t know any better and don’t enough know enough to ask.

Before we dive into what robots and artificial intelligence are doing, let’s look at where companies are heading with their business models.

Before we dive into what robots and artificial intelligence are doing, let’s look at where companies are heading with their business models.

There have been countless news stories and opinion columnists citing statistics and reports on start-ups poised to shake things up. Admittedly, the numbers are impressive. Investor funding runs well into nine figures for the two largest direct homebuyers, Opendoor ($320 million) and OfferPad ($260 million).

As entrepreneurs and investors have continued to gravitate towards the various opportunities offered within real estate, the Real Estate Tech ecosystem has grown in both size and scope. Since 2012, Real Estate Tech companies have received over $6 billion in funding, with companies raising $2.6 billion in venture capital in 2016 alone, a substantial increase from the $1.9 billion reported in 2015. With over 100 real estate focused startups receiving early stage funding in 2016 and later stage tech enabled real estate companies like Compass (raised $450 million in early December 2017) and Redfin ($138 million IPO in July 2017) raising substantial amounts of capital, the sector has undoubtedly piqued the interest of consumers, investors, and industry players alike. Not to mention Zillow.

What are these companies doing that makes investors so excited they are willing to pump in hundreds of millions of dollars into them? They are creating mega-tech one-stop-shop companies that are meant to take over your life.

First up, let us look at Rocket Mortgage.

I’m sure you have heard of Rocket Mortgage by now. Rocket Mortgage is owned by Quicken Loans, and had it’s coming out party during the 2016 Super Bowl Ads. According to housing wire, Quicken Loans was #1 in 2017 by transaction volume and looks to be heading to the number #1 spot for 2018 as well. Quicken did have true innovation when it comes to Rocket Mortgage, and they were rewarded with the top spot in the country for lenders by both the highest number of transactions and largest volume of mortgages.

(Full disclosure: I’m not a Quicken Loan fan, but I can still respect some of the technology they have created and implemented into their company.)

So, what did Quicken Loans do that is different than many lenders? A couple things.

- Ease of Use. They turned what used to be a cumbersome process of applying for a mortgage to a thing you can do from your phone in your own time, saving consumers a lot of the hassle. They took a process that would typically take 30-60 days and crunched it down to roughly 10 days by automating most of the process into an algorithm. I think they say something about approving (or denying) your loan in as little as 8 minutes. The appraisals delay the process to 10 days, since those are still are done by humans.

- Centralized Data. They linked almost everything you do online into a single portal to help speed the process. Forget the days of having to comb through paper bank statements and email those to your lender or drop them off. Quicken links their portal into your bank directly to access your bank statements, current available funds, and even history of deposits. Some employers now verify your employment status through their app, and no longer require people to talk with managers. It’s not 100% online, but it is sure close to it, and probably will be in the very near future.

- One-Stop-Shop. The Quicken Loans family looks a lot like it’s trying to be the Amazon of lending. Did you know, Quicken owns approximately 81 other companies (not including their additional “partnerships”) with everything from Financial Services, Financial Tech Companies, Online Technology Companies, Home Furnishings, Investment Services, Architect Services, Accounting, Billing & Receivables, Website & Design, Gaming, Hotels, Casinos, Home Flipping and Renovations, Online Schools, Security Services, Property Management, Real Estate Sales, Multiple Venture Capital Firms, Self Driving Cars, and countless companies all aimed at online technology, web presence, and improving efficiency for business.

Hey, that’s just one company. You can’t use one company as an example of where the whole industry is heading!

That’s true.

Let’s look at the nation’s number two lender. LoanDepot. LoanDepot launched mello Home earlier this year, which is a service that connects buyer clients to their agents. Sounds like another “one stop shop” approach, like Amazon. And, it is. I won’t make you sit through the list twice, but it’s pretty much the same thing with a variety of separate companies all brought together under one roof.

What about number 3, 4, 5, etc? Yup. They are all attempting to create a one-stop-shop for services with the hope of having you spend less time shopping services between companies and more time just writing them one big fat check instead of a bunch of small ones.

Ok, so what about robots and artificial intelligence taking over human jobs? Should traditional brokerages feel threatened? Maybe. But, probably not.

While these technological advances are meant to eliminate the human element, humans are still necessary in a lot of ways. Elon Musk (PayPal, Space-X, Tesla, SolarCity, and The Boring Company) will tell you that humans are underrated and that he brought people back into Tesla to help smooth the process and speed things back up in his production line. His robots got too unwieldy and slowed things down!

So if robots alone are too cumbersome and humans alone are too slow, what is the answer?

A human-machine symbiosis. That is what we should be talking about. Creating robots to enhance human services, not to replace them.

I’m sure you have heard the opinion that real estate agents and lenders will soon be replaced by technology. However, I tend to think that the agent-centric model has staying power, though it will look a bit different in the future.

In my opinion, the new technology (whether you mean software, applications, block-chain, robots, etc) should work to accelerate the closing process and smooth out some of the hurdles. Loans could become faster. Property information may be easier to find. Title issues could be quicker to address or monitor. But at the end of the day, it still involves people.

While this massive collection of data and introduction of search portals has increased the amount of information available and speed to get to it, it has not provided anyone with the context necessary to make a decision. Media company models focus on optimizing for page-views and clicks, yet fail to support crucial channels of information exchange between agents and clients. This is proven by the increased demand for agents over the last two decades even with the introduction of platforms such as Trulia and Zillow.

Why do I think that real estate and lending professionals will remain essential?

Simply because humans are better at some things than robots.

For example:

- EMOTIONS. First, buying a home is typically the largest financial transaction in a person’s life. It is highly emotional, and occurs infrequently. Consumers want practical, cultural, and emotional guidance as they navigate this decision. Why can I stand here and say without a doubt that people want guidance in this area, despite the available online information? Because we have already created a new industry of “consultants” for online services. For example, you hire a person to manage your SEO, a person creates the content for social media, and you can even hire a consultant to improve your odds with online dating! Seems a little backwards with the “online”, doesn’t it? This is want people want, so I’ll take it as a glimmer of hope.

- QUALITY OF CARE. Second, real estate agents and lenders perform many functions which software can only partially eliminate. Certain tasks should and will be automated, such as scheduling and paperwork. We recently had a lender in Washington State who had their loan documents signed with a notary through a video-conference session. But, technology doesn’t allow for coordinating with all the other parties, staying up on local policy changes, politics, etc. The dirty word of “closing” a sale still requires a human touch because it requires you to consider all the options around the property aspects, your lifestyle choices, and your desires for the future.

- Hyper-Geographic Expertise. Third, as much as we may not want to admit, agents remain the most cost-effective method for sellers to find buyers. Hyper-geographic expertise allows agents to offer buyers a smooth process to closing and access in a private real estate marketplace. You are still dealing with people’s homes and businesses. While automated brokerages seem elegant and low-touch, when you factor in the human pieces and the various conversion points necessary to help a person buy a home (marketing, filtering real buyers from the tire kickers, protecting clients from being taken advantage of by vultures, and mid-escrow re-negotiations when something goes wrong, etc.), these programmed platforms are far less efficient and likely lead to failure when left on their own. Although humans are not scalable, they are a fundamentally cheap mode of customer acquisition and the best assurance your transaction makes it to closing.

- Relationships. Finally, real estate may be about properties, but it is ultimately an industry that centers around people. Technology can support those relationships, but it will not replace them.

Given these observations, I believe that a successful real estate platform will augment agents with data and tools to accelerate their business and serve their clients better.

Some areas where I hope to see great improvements are:

- Embrace Technology: Whether it’s new ways to streamline transactions (DocuSign, zipLogix, virtual notaries, etc.) or better ways to market properties (virtual staging, virtual tours, etc), there are countless ways to make the customer interaction more seamless.

- Targeted marketing: Most real estate marketing takes the form of untargeted spray and pray tactics. This is true even with Facebook ads (don’t get me started!). What we aim for enables intelligent, personalized agent-to-agent marketing by matching a buyer’s demand with available inventory, or matching it with potential inventory through something like Zillow’s Make Me Move concept.

- Property pricing: At present, there is no way to “guarantee” what a property is worth. Zillow doesn’t have the answer either and will pay you one million dollars to help them figure it out. Pricing is both art and science and requires a lot of personal analysis, local knowledge, and old-fashioned boots on the ground approach, day-in and day-out, in order to be competent in the game of ever-changing market values.

- Streamlined Process: There is still a lot of manual labor involved with buying a property. Lenders, such as Quicken Loans, realized this and have tried to streamline as much as they can with their app. Maybe one day, the process will be streamlined across the board and all you need to do is schedule the closing date and then automatically your utilities, loan, insurance, and more are all pro-rated and magically accounts are opened and closed as needed. That day might be closer than we think.

- Changing Ideals: With Wi-Fi capabilities and/or cell-phone coverage almost everywhere (even a wi-fi hotspot in my truck!) people are no longer tied to an office. You can browse properties or sign contracts with the swipe of your finger while sitting at a Little League game or out on the beach.

While the technology to find data or accomplish transactions has improved, the basis for decision making or in-depth understanding about the process has not progressed forward, and in many ways I feel it is taking leaps backwards. Maybe there will be a change in direction and people will begin to expect a higher level of competency with all this technology we are creating. The data is there. We just need to teach people how to use it!

Moving forward, let’s focus on integrating humans and robots, not replacing humans with robots.

If we are going to see any real advances in real estate technology, it will be to improve the agents or lenders ability to educate their clients by interpreting and telling stories with data. Buyers and Sellers will want someone who can tell narratives about past work in a neighborhood, draw attention to unusual features of a property, and help frame the price of a new home in terms of financial and demographic trends. Real estate agents and lenders with sophisticated tools will likely perform these functions better than automated brokerages for decades to come, but it takes work. Don’t forget that on the other side of that post is a real live person. Be nice.

In the words of Elon Musk (ok, it was a tweet), “Humans Are Underrated”. Finding applications that help humans become more efficient is a better bet than creating applications to replace humans completely. In real estate and lending, there will always be a demand for humans who are experts in their field and provide consumers with more meaningful experiences.

Need help getting started? We are happy to point you in the right direction with data that can be trusted and help you make connections with the people you need to know.

Jen Hudson | (206) 293-1005 | jen@hudsoncreg.com

Duane Petzoldt | (425) 239-1780 | duane@hudsoncreg.com

Commercial RE Appraisal Changes

Did you know? On April 9, 2018, the FDIC changed their rules. Per the federal agencies, commercial real estate transactions below $500,000 will no longer be required to have an appraisal.

Remember, just because the FDIC doesn’t require something… that doesn’t mean your local lender or bank won’t.

Want to read the full rules? Check them out here.

If you need help getting prepared for your next investment or business purchase, give us a call.

Jen Hudson

(206) 293-1005 or jen@hudsoncreg.com

Duane Petzoldt

(425) 239-1780 or duane@hudsoncreg.com

The Problem with Snapshots. by Jen Hudson

If you know me, then you know that I care about the facts. I don’t mean facts in the sense that “fake news” is overtaking our world. That’s for a different discussion. Just because you can find 6 friends on Facebook to agree with you, doesn’t mean you get to change the truth.

No, I mean the issue that I have anytime someone says something like “we have a shortage of housing!”.

Let’s look at some true facts and figures for our area and talk about how markets work in real life.

The Typical Graph

Here is the typical “chart” that I see floating around real estate offices or online. I borrowed this one from Trulia. Let’s look past the part where it is now March, and yet they are showing me data between May-August from some unknown year.

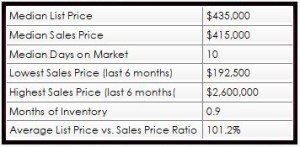

Or sometimes we see information like this. I stole this data from Redfin and would like to assume it’s current.

| Median List Price | $875k |

| Median Sales Price | $700k |

| Average Sale/List Price | 107.4% |

| Average Number of Offers | 4.4 |

| Median List Price/Square Foot | $471/sf |

So, these are great and everything… but what can you learn from them?

I will tell you. Trulia’s graph makes you think prices are skyrocketing and creating a bubble, right? Redfin makes you think everything sells with multiple offers and prices jump leaps and bounds, no matter what price you put on your home.

But, do you want to know a secret? Pricing is really all about the market, and the market always comes back to economics 101. Supply versus Demand.

Yes, it is really that simple.

But what numbers do you need to know to understand what is happening in the real estate market?

Let’s dig a little further in our real-life, local example, and show you what you are missing.

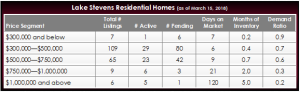

Let’s look at Lake Stevens to start. What would you think if you saw the following information about Lake Stevens real estate?

Based on this, it appears that homes are flying off the shelf in Lake Stevens. If I’m a seller, I expect that magically all I need to do is list my house and then about a week later, it will be sold. As a seller, I’m also pretty sure that my house must be better than the ones that sell for $415,000, so it will of course sell faster.

Maybe. But, maybe not. Have you walked through what sells for $415,000 lately? It’s different than what sold for $415,000 a couple years ago.

This is clearly not enough information. Let’s dig further.

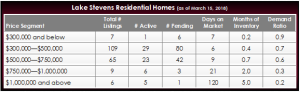

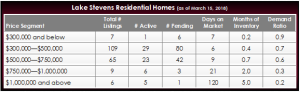

Now what do you think when you see the information expanded into a little more detail?

This is interesting too. It appears that there is an entire range of homes selling in just 10 days. I could sell my trailer in the woods or my waterfront estate in roughly a week and for a little more than I ask for! Clearly everything is selling for 100.01%!

This is better, but it is still not ideal.

Now, let’s break up our information a little bit more and really dive into the activity in each price segment.

Pro-tip: Pricing Segments are keys to understanding market movement.

Alright. Now we are talking. This information is useful.Side bar: These are wide price segments shown for discussion purposes only. In real life, I will break them down even further into ranges that would encompass your specific property and location, to get a true gauge of demand and activity. For example, if your home is worth $450,000, then we will probably look between $400,000-$500,000, since that may be the range a typical buyer for your property looks at.

Let’s point out a couple things that may or may not be obvious.

Price Segments. By segmenting everything into targeted price points, I can now see that there are 109 homes in Lake Stevens priced between $300-$500k and an additional 65 homes priced between $500-$750k. I can also see that there are far fewer homes on both the lower end below $300k and the upper end above $750k, or 7 and 15 homes respectively.

I would not have known this with a general price statement, so now you can see where the competing homes for sale are.

Days on Market. Days on market is great, but only when it is used in your targeted price segment. Buyers want to know how quickly they will need to make and offer. Sellers want to know how long they can expect before they need to pack up and move.

Remember that Days on Market is not a set number. Homes will always sell for what the market is. If it is priced lower, it could mean bidding wars and multiple offers immediately. If a property is priced too high, it will sit for a little longer.

Activity & Demand. This is cool too. Do you notice how there are currently 80 buyers between $300-$500k and another 42 buyers between $500-$750k, yet there are only a handful for the lower and upper ends? It’s something to consider, whether buying or selling. You need to position yourself correctly and understand where you are within each price segment.

Months of Inventory. We have all heard of buyer’s markets and seller’s markets. But, what is that about? First, you need to understand that all statements about months of inventory make a lot of assumptions.

They essentially say… “Assuming there are no additional listings that come on the market, no additional properties that go off the market, and a steady flow of buyers who will consistently continue to buy homes at the same rate they have over the past 6 months (or 12 months or whatever number you are using for data), then it will take XX number of months to sell the rest of the available homes.”

Is that a real life scenario? No.

I do think the months of inventory is a good gauge to look at and keep in mind when trying to price your property strategically, but it is also important to recognize there are other things at play beyond our control. Things like the season, weather, interest rates, local economy, community development (or lack of), employers, global economic forces, and more.

Demand Ratio. The demand ratio is something I made up, but it gives us a very realistic perspective of where the buyers are, and in a very common sense way. Let’s define the demand ratio as number of pending homes divided by number of homes listed on the market (active plus pending).

For example, if there are 80 buyers under contract (pending) and 109 sellers wanting to sell (80 pending plus 29 active), they have a demand ratio of 0.7 (80 divided by 109). This is a good strong number if I’m a seller and means there is a lot of competition if I’m a buyer. What we have just figured out is that for every home on the market, there are 0.7 buyers looking for it.

However, if there is only 1 buyer under contract above $1 million, and 5 homes left to choose from over (means 1 pending plus 5 active = 6), then my demand ratio has dropped significantly to 0.17. Now, the ball is in the buyer’s court with a plenty of options to consider and low competition from other buyers.

Some obvious things to point out:

- If we are talking about a demand ratio and there are no buyers in that price range and area… then the demand is zero (0). If you are a buyer, this is a wonderful time to shop since you are your only competition. If you are a seller, then you had better get realistic about your price to try and attract all potential buyers. Period.

- If all the homes on the market are under contract or pending, then your demand ratio is one (1). In that case, if you are a buyer then you will need to be ready to pounce immediately on the next opportunity that comes along.

If you are a seller, you still can’t be greedy. While it is tempting to want to test the waters a little, remember than an overpriced property is still overpriced.

Sales Price versus List Price Ratios.

You may have noticed that I did not include any information about what the ratio for sales price versus list price.

Here’s my two cents and opinion on the topic.

I think agents need to know what their sales price versus list price ratio is, but I think this number is misinterpreted. With the correct exposure and negotiating for any property, a professional agent will be able to get you the best of what the market will bear.

I am sure you have talked with someone or seen statistics where a home received 15 offers and sold for 112% of it’s list price. Many people use it almost like bragging rights today… but this isn’t something they would brag about if they understood what happened.

Multiple offers and a bidding war might be great in most seller’s minds, but do you know what I think? I think that whoever the agent was didn’t understand their market at all and was a disservice to their client instead.

Consider the numbers. If you are the seller in Lake Stevens with a $415,000 home… that means your agent almost lost you 12% or $49,800 in your sale. Something to think about anyway.

For me personally, as a Seller’s agent my list to sales price ratio is 101.7% based on the last year. This indicates I am a little more aggressive for pricing and pulled in a couple buyers to use against each other to bid the property up. In this market this competitive strategy works, but it depends on your price segment and demand ratios.

As a Buyer’s agent, my list to sales price ratio is 95.5%, indicating I find deals for my clients and know how to negotiate them down to favorable terms.

The Big Secret About Obvious Information

Here is one last thing to keep in mind. In many circumstances like we have today, this is the optimal time to “move-up” into your next almost dream house. Depending on your location and the market conditions, you could easily be in a “seller’s market” as you sell your $450k home and quickly shift into your next move into a slower moving balanced or buyer’s market, as you purchase your new $700k home. The different segments within the market, plus the equity you may have earned in your current home could start to pay off much more quickly than you realize and ultimately get your closer to your dreams.

The next time you see a generic graph or table with basic information, take a moment to consider what is really going on in the market. Of course, if you need help and want real answers from a true professional, then I’m easy to find most any day except Sundays.

I hope this helps you with your plans toward the big picture. My partner Duane and I would be honored to help you with your next move or investment… since it is an amazing time to take advantage of what other people don’t know or just can’t see. You can call Jen at (206) 293-1005 or Duane at (425) 239-1780.

Cheers!

Jen Hudson & Duane Petzoldt

Tax Update: Victory!!!… Maybe? by Jennifer Hudson

I have never claimed to have a crystal ball, but this is the first time in the last 13 years where I feel the need to send out an update right away.

I have never claimed to have a crystal ball, but this is the first time in the last 13 years where I feel the need to send out an update right away.

If you missed the most recent newsletter, it was about the exciting world of taxes. At the time of writing the last newsletter, the tax plans that were presented by both the House and the Senate proposed increasing the exemption for capital gains on a primary residence from a required 2 of the last 5 years up to 5 of the last 8 years. No one was excited about that in the real estate world, and we started making some calls.

After a little shuffle, we pulled off a WIN! In the final version, the capital gains exemption was left alone and still requires you to live in your property as a primary residence for 2 of the last 5 years in order to be exempt from capital gains. Score!

Bring on the conversion of a primary residence (for only 2 years!) to future rental (for no more than 3 years) game once again! With the market on the upswing, we can build some real equity!

Unfortunately, we lost a different tax benefit instead. You know how we have talked about Home Equity Lines of Credit (HELOC) in the past? Well, the interest on a HELOC used to be tax deductible. Today, it is no longer able to be written off on your taxes.

That makes me a little sad too, but it might be a blessing in disguise.

Maybe the loss of the HELOC tax deduction will actually cause people to pause for a moment before just taking out more debt on their homes. It’s possible, right? Time will tell.

In the meantime, I hope you all had a wonderful New Years and got to spend time with those you care about. I know I did. But now, it’s time to get back to work and invest wisely… and always with an eye on the future.

Looking for projects? Me too. Let’s look together. Call me at (206) 293-1005 or email Jen@HudsonCREG.com for a quick refresher on where the market it at.

Remember… even though prices are higher than they have been, you make money on the purchase, NOT on the sale. Run your numbers carefully before writing checks. Let’s make this a great year!

Market Intelligence Matters.

Knock Knock. Who’s There? The IRS. by Jennifer Hudson

I think many of you are familiar with the whole “2 year tax game.” You know what I’m talking about, right? The one where if you use a property as your primary residence on your tax returns for at least 2 of the previous 5 years, you can avoid capital gains.

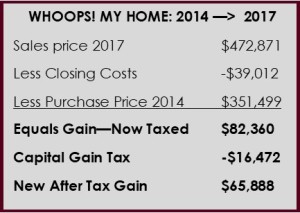

How does… I mean DID… this work in real life? Let me show you.

In December 2012 in Everett, the average sales price for a home was $306,761. In December 2014, it was $351,499. In December 2017, it was $472,871… geez! That’s a lot of money in Everett.

In December 2012 in Everett, the average sales price for a home was $306,761. In December 2014, it was $351,499. In December 2017, it was $472,871… geez! That’s a lot of money in Everett.

Let’s say that you purchased your house in 2012 for $306,761 and then sold in in 2014 for $351,499.

(Psst… check out the chart MY HOME: 2012->2014)

If you sold it in 2014 for $351,499, the capital gain tax was magically waived. Well, it’s not magically with elves or anything. It is the tax code, after all.

If you had an extra $15,738 for just living in the home, that seems like a pretty sweet deal.

But, what if you stayed longer and just sold this year in 2017 instead?

(Psst… check out the chart MY HOME: 2012->2017)

Now we’re talking. This looks pretty good right? An extra $127,098 because you were in the upswing of a market. Not bad.

But, that is where most people stop playing the game.

THE EXPANSION SET.

You know how cool card games, like “Cards Against Humanity” or something will get such a great response that they then create expansion sets to keep people coming back?

There is… I mean was…. an expansion set for this tax game too. It’s called the rental property expansion set.

And, this game is one I was playing. Well, still will… but way slower than before, which makes me sad.

Let’s say you bought the home in 2012 and moved out in 2014. You didn’t sell in 2014. Instead you decided to rent the home for 3 years before selling. So, what does that look like? Let’s see.

Ok, but let’s look closer at the investment side.

Rental Income. Let’s say that you rented the house out and after all expenses, maintenance, insurance, property taxes, interest on your mortgage, etc… you were making $1,525 per month income.

$1,525/month x 36 months (or 3 years) = $54,900 in additional income

Depreciation. Now, with an investment property, you also get to depreciate it on your taxes, which reduces your taxable income overall. Let’s say that I was able to depreciate $8,521 per year, or a total of $25,563.

Not to get too complicated, but you’ll have to pay 25% of this back at closing as a depreciation recapture tax to the IRS. Don’t worry about it too much. You were still ahead all the other years. It’s not perfect, just an example.

With this new investment property scenario, what does my income look like now? Let’s see.

(Psst… check out the Expansion Set Chart)

Now we’re talking. You got a house to live in for 2 years which paid you. Plus, you had an investment property for 3 years, which overall paid you too. An extra $201,171 sounds pretty sweet!

NEW TAX PLANS. THINK “5 OF THE LAST 8”.

So what is the change that both the senate and house are talking about?

Well, they want to take the primary residence exemption and expand that to 5 years from the current 2 year period. This means you need to live in your house for a full 5 years on your tax returns before moving.

While there is still not a reconciliation for the new tax plan at the time I am writing this, BOTH the house and senate bills take the primary exemption and extend that requirement to 5 of the last 8 years.

So, in this real-life example above, I would have a surprise $25,420 tax bill (20% tax on the gain of $127,098). If I’m not ready for that, it’s a big surprise.

So, what if I never used the property as a rental and just sold it “early”? What does this new sale look like to someone who bought a house in 2014 instead of 2012? Let’s take a peek.

(Psst… check out the Whoops! Chart)

It’s still great that you get $65,888 after tax on your return. But, that’s still a “surprise” $16,472 tax bill that no one has been accounting for.

The biggest challenge with this scenario is that all the people who have their homes under contract right now but won’t close until 2018 could be left for a bit of a shock come next tax season. In one version of the bill you are protected if you are under contract, the other other… you are just out of luck.

PERSONAL OPINION TIME.

Let’s be real for a moment, shall we?

Issue One – Saving. As a nation, we appear to have a real challenge saving money. I’m not perfect by any means, but I’m trying to learn.

For a lot of people, a “surprise” you owe the IRS an extra $16,472 could really throw off their year and plans. The part I don’t understand is how no one is talking about this.

So yeah, this scares me a little for many of my friends and clients.

You know what else scares me a little bit more?

Issue Two – Understanding Cash at Closing. I feel like a lot of people forget… the dollars you see at closing are NOT the dollars that are taxed by the IRS. The IRS doesn’t care one bit about whether you have a mortgage on a property. That’s your choice.

If you have a home equity line of credit or HELOC against your property that “eats up” all the extra cash at the end, that doesn’t change anything about what you owe the IRS come tax season.

I see a lot of people… and predict that a WHOLE LOT MORE will start taking out home equity lines of credit or HELOCs on their homes in 2018. Why? Because they can.

If you think about it, your lender just sold you a 3.5% mortgage for 30 years. You’re probably not going to give that up. However, I bet that you will go get a line of credit for a slightly higher rate to pull a bunch of money out of your home so you can make improvements or put the kids through college or just go to Disneyland. Whatever it is, a 5.5% HELOC is still cheap and you figure it will be paid back in no time.

Except, what happens when there is an emergency and you really do need to sell your home before the end of 5 years or before the HELOC is paid back? In the scenario above, anyone with a line of credit for more than $65,888 may have to pay money to sell their house instead.

What was previously a break-even scenario could quickly turn into a tax problem if you don’t think ahead.

This potential unseen tax bill combined with future over-leveraged homes scares me too. We did this already. It was called 2006-2009.

Issue Three – Inventory and Housing.

Do you know what concerns me the most right now? It’s the simple fact that this tax plan has many unintended consequences. For example, it may lead to less homes for sale… which will continue to drive our prices up at rates that are not sustainable.

Remember how real estate is about supply & demand? Well, we have a supply issue for the most part. If you haven’t noticed, there are not many homes for sale or rent right now and that is driving up prices both for purchase and prices on rental properties.

As a home owner, I was previously planning on selling 2 homes in 2019. One is my residence and the other is a rental. Now? I don’t plan on selling either of those for the simple issue of taxes that will accompany it. I do pay the IRS every year, but I don’t enjoy it. So, I have now personally added to the inventory shortage problem, which will continue to impact appreciation rates and rental prices. Of course, this makes it less affordable for others no matter which side they are on.

Could I get into the 1031 exchange and start the deferring my taxes? Sure, but it is like heroin (I assume… I’ve never done it). Once you start, it’s hard to stop. The taxes owed just keep rolling over and piling up.

Why do I tell you these things? For starters, I want to try and make people’s lives better. I think you should be aware of what is going on and I think there should be more people talking about true issues and less hype in the world. It drives me crazy that it has become so difficult to find real news.

Second, I think people should do more planning for the future and working just a little bit every day to make that happen. Think of planning for the future like tooth maintenance. Does brushing your teeth once make a difference? No. Does brushing your teeth twice everyday make sure you keep your teeth? Sure does.

I would absolutely love to help you sell your house this next year. Do I think you should? That depends on your life plan and goals moving forward. It’s not about the moment. It’s time to think about the future.

Remember, markets don’t go up forever, but considering the natural disasters, local economy, new jobs, housing, cost of money, and a whole lot more…. I think we have a little while left still before a major shift. So far, this feels like a slow squeeze instead of a bubble, but depending on how you plan, that could be ok.

When you are ready or when you just want to talk, I am here to help.

(206) 293-1005 or jen@hudsoncreg.com any day except Sunday

Market Intelligence Matters. Read Next.

BREXIT. How Forces Influence Housing.

In case you missed it… recently the UK voted to Brexit from the EU.

BACK-UP.

This month’s read is less about the British withdrawal from the European Union and more about how world markets may or may not influence our local housing here at home in ‘Murica. Continue reading “BREXIT. How Forces Influence Housing.”

4Q15 Apartment Guide

If I’m an investor looking at the Apartment Market in the Puget Sound, I sure have a lot of questions. Things like…. Continue reading “4Q15 Apartment Guide”

A Crazy Little Thing Called… FIRPTA. By Jen Hudson

You’re telling me there is a chance that the buyer pays the seller’s taxes??? How is that??? Continue reading “A Crazy Little Thing Called… FIRPTA. By Jen Hudson”