I think many of you are familiar with the whole “2 year tax game.” You know what I’m talking about, right? The one where if you use a property as your primary residence on your tax returns for at least 2 of the previous 5 years, you can avoid capital gains.

How does… I mean DID… this work in real life? Let me show you.

In December 2012 in Everett, the average sales price for a home was $306,761. In December 2014, it was $351,499. In December 2017, it was $472,871… geez! That’s a lot of money in Everett.

In December 2012 in Everett, the average sales price for a home was $306,761. In December 2014, it was $351,499. In December 2017, it was $472,871… geez! That’s a lot of money in Everett.

Let’s say that you purchased your house in 2012 for $306,761 and then sold in in 2014 for $351,499.

(Psst… check out the chart MY HOME: 2012->2014)

If you sold it in 2014 for $351,499, the capital gain tax was magically waived. Well, it’s not magically with elves or anything. It is the tax code, after all.

If you had an extra $15,738 for just living in the home, that seems like a pretty sweet deal.

But, what if you stayed longer and just sold this year in 2017 instead?

(Psst… check out the chart MY HOME: 2012->2017)

Now we’re talking. This looks pretty good right? An extra $127,098 because you were in the upswing of a market. Not bad.

But, that is where most people stop playing the game.

THE EXPANSION SET.

You know how cool card games, like “Cards Against Humanity” or something will get such a great response that they then create expansion sets to keep people coming back?

There is… I mean was…. an expansion set for this tax game too. It’s called the rental property expansion set.

And, this game is one I was playing. Well, still will… but way slower than before, which makes me sad.

Let’s say you bought the home in 2012 and moved out in 2014. You didn’t sell in 2014. Instead you decided to rent the home for 3 years before selling. So, what does that look like? Let’s see.

Ok, but let’s look closer at the investment side.

Rental Income. Let’s say that you rented the house out and after all expenses, maintenance, insurance, property taxes, interest on your mortgage, etc… you were making $1,525 per month income.

$1,525/month x 36 months (or 3 years) = $54,900 in additional income

Depreciation. Now, with an investment property, you also get to depreciate it on your taxes, which reduces your taxable income overall. Let’s say that I was able to depreciate $8,521 per year, or a total of $25,563.

Not to get too complicated, but you’ll have to pay 25% of this back at closing as a depreciation recapture tax to the IRS. Don’t worry about it too much. You were still ahead all the other years. It’s not perfect, just an example.

With this new investment property scenario, what does my income look like now? Let’s see.

(Psst… check out the Expansion Set Chart)

Now we’re talking. You got a house to live in for 2 years which paid you. Plus, you had an investment property for 3 years, which overall paid you too. An extra $201,171 sounds pretty sweet!

NEW TAX PLANS. THINK “5 OF THE LAST 8”.

So what is the change that both the senate and house are talking about?

Well, they want to take the primary residence exemption and expand that to 5 years from the current 2 year period. This means you need to live in your house for a full 5 years on your tax returns before moving.

While there is still not a reconciliation for the new tax plan at the time I am writing this, BOTH the house and senate bills take the primary exemption and extend that requirement to 5 of the last 8 years.

So, in this real-life example above, I would have a surprise $25,420 tax bill (20% tax on the gain of $127,098). If I’m not ready for that, it’s a big surprise.

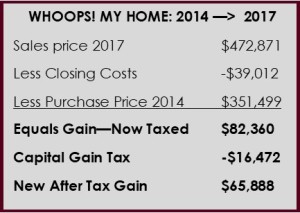

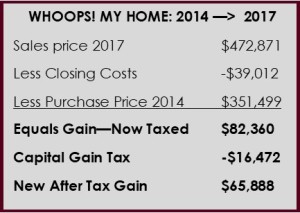

So, what if I never used the property as a rental and just sold it “early”? What does this new sale look like to someone who bought a house in 2014 instead of 2012? Let’s take a peek.

(Psst… check out the Whoops! Chart)

It’s still great that you get $65,888 after tax on your return. But, that’s still a “surprise” $16,472 tax bill that no one has been accounting for.

The biggest challenge with this scenario is that all the people who have their homes under contract right now but won’t close until 2018 could be left for a bit of a shock come next tax season. In one version of the bill you are protected if you are under contract, the other other… you are just out of luck.

PERSONAL OPINION TIME.

Let’s be real for a moment, shall we?

Issue One – Saving. As a nation, we appear to have a real challenge saving money. I’m not perfect by any means, but I’m trying to learn.

For a lot of people, a “surprise” you owe the IRS an extra $16,472 could really throw off their year and plans. The part I don’t understand is how no one is talking about this.

So yeah, this scares me a little for many of my friends and clients.

You know what else scares me a little bit more?

Issue Two – Understanding Cash at Closing. I feel like a lot of people forget… the dollars you see at closing are NOT the dollars that are taxed by the IRS. The IRS doesn’t care one bit about whether you have a mortgage on a property. That’s your choice.

If you have a home equity line of credit or HELOC against your property that “eats up” all the extra cash at the end, that doesn’t change anything about what you owe the IRS come tax season.

I see a lot of people… and predict that a WHOLE LOT MORE will start taking out home equity lines of credit or HELOCs on their homes in 2018. Why? Because they can.

If you think about it, your lender just sold you a 3.5% mortgage for 30 years. You’re probably not going to give that up. However, I bet that you will go get a line of credit for a slightly higher rate to pull a bunch of money out of your home so you can make improvements or put the kids through college or just go to Disneyland. Whatever it is, a 5.5% HELOC is still cheap and you figure it will be paid back in no time.

Except, what happens when there is an emergency and you really do need to sell your home before the end of 5 years or before the HELOC is paid back? In the scenario above, anyone with a line of credit for more than $65,888 may have to pay money to sell their house instead.

What was previously a break-even scenario could quickly turn into a tax problem if you don’t think ahead.

This potential unseen tax bill combined with future over-leveraged homes scares me too. We did this already. It was called 2006-2009.

Issue Three – Inventory and Housing.

Do you know what concerns me the most right now? It’s the simple fact that this tax plan has many unintended consequences. For example, it may lead to less homes for sale… which will continue to drive our prices up at rates that are not sustainable.

Remember how real estate is about supply & demand? Well, we have a supply issue for the most part. If you haven’t noticed, there are not many homes for sale or rent right now and that is driving up prices both for purchase and prices on rental properties.

As a home owner, I was previously planning on selling 2 homes in 2019. One is my residence and the other is a rental. Now? I don’t plan on selling either of those for the simple issue of taxes that will accompany it. I do pay the IRS every year, but I don’t enjoy it. So, I have now personally added to the inventory shortage problem, which will continue to impact appreciation rates and rental prices. Of course, this makes it less affordable for others no matter which side they are on.

Could I get into the 1031 exchange and start the deferring my taxes? Sure, but it is like heroin (I assume… I’ve never done it). Once you start, it’s hard to stop. The taxes owed just keep rolling over and piling up.

Why do I tell you these things? For starters, I want to try and make people’s lives better. I think you should be aware of what is going on and I think there should be more people talking about true issues and less hype in the world. It drives me crazy that it has become so difficult to find real news.

Second, I think people should do more planning for the future and working just a little bit every day to make that happen. Think of planning for the future like tooth maintenance. Does brushing your teeth once make a difference? No. Does brushing your teeth twice everyday make sure you keep your teeth? Sure does.

I would absolutely love to help you sell your house this next year. Do I think you should? That depends on your life plan and goals moving forward. It’s not about the moment. It’s time to think about the future.

Remember, markets don’t go up forever, but considering the natural disasters, local economy, new jobs, housing, cost of money, and a whole lot more…. I think we have a little while left still before a major shift. So far, this feels like a slow squeeze instead of a bubble, but depending on how you plan, that could be ok.

When you are ready or when you just want to talk, I am here to help.

(206) 293-1005 or jen@hudsoncreg.com any day except Sunday

Market Intelligence Matters. Read Next.

I have never claimed to have a crystal ball, but this is the first time in the last 13 years where I feel the need to send out an update right away.

I have never claimed to have a crystal ball, but this is the first time in the last 13 years where I feel the need to send out an update right away.

In December 2012 in Everett, the average sales price for a home was $306,761. In December 2014, it was $351,499. In December 2017, it was $472,871… geez! That’s a lot of money in Everett.

In December 2012 in Everett, the average sales price for a home was $306,761. In December 2014, it was $351,499. In December 2017, it was $472,871… geez! That’s a lot of money in Everett.