You’re telling me there is a chance that the buyer pays the seller’s taxes??? How is that???

FIRPTA. Sounds like a new ap, right? I’m sure all the kids are using it.

Want to hear something scary? I would bet money that until a week ago, most real estate professionals heard FIRPTA and thought… “oh yeah, something like that was on my real estate test to get a license.”

Well, FIRPTA is much bigger than a test question. The potential results are something that I watch closely through escrow during the transaction… along with a lot of other costs and pro-rations, of course.

SIDEBAR.

Escrow officers tell me all the time that most people don’t even know how to read a settlement disclosure statement, let alone have the guts to question it. Yet every deal I work on, I’m changing something on the statement for my client. Do yourself a favor and work with agents who understand the details and how the pieces interact.

BACK TO FIRPTA. LET ME EXPLAIN.

FIRPTA. It stands for the Foreign Investment in Real Property Tax Act.

Sounds sexy, right? Yeah… I didn’t think so either.

Did you know that as a buyer of real estate in the United States, you are just hoping each and every time that you close on a purchase that the seller either 1) is a US tax payer or 2) if they aren’t, that they will pay their taxes?

My guess is that is probably news to you.

HERE’S THE SCOOP.

If a foreign entity (could be an individual, corporation, partnership.. doesn’t matter) sells real estate in the United States, they are supposed to pay taxes on capital gains from that sale.

Except… sometimes they don’t. It’s really hard for the Internal Revenue Service to try and track down people around the globe to pay tax bills. It’s even harder to try and figure out what the capital gains were without all the records.

Instead of tracking people around the world, the Internal Revenue Service found an easier solution. They stick the new buyer with the bill. What?

Yup.

HERE’S HOW IT WORKS.

Unless the buyer withholds a certain amount at closing from the proceeds or the seller seeks permission or a waiver ahead of time from the Internal Revenue Service, the buyer WILL BE RESPONSIBLE for the seller’s obligations for taxes if they purchase from a foreign seller. This is because it is easier for the IRS to find you (as a local buyer) than it is to find a seller somewhere around the globe. I mean, they know where your property is, so why not go after you instead?

From an IRS standpoint, it does make perfect sense.

Personally, this seems a bit heavy-handed, especially considering that most buyers have no clue about the law in the first place.

Here’s the thing though. If you have a real estate professional represent you on a deal as a buyer and help you purchase a property… they should know about this. It’s their job. No offense to any particular people out there… but I’ve seen some of the agents in the industry and I would be afraid for them to represent me on anything.

FIRPTA. LET’S TALK SPECIFICS.

In addition to the unknown law, it’s changing and getting a rate hike on February 17, 2016.

Under the provisions of the Foreign Investment in Real Property Act (FIRPTA), the buyer is required to withhold from a foreign seller and pay to the Internal Revenue Service (IRS), a prepaid tax based on the amount realized (sales price) upon the sale of any U.S. real property. On December 18, 2015, the Protecting Americans from Tax Hikes (PATH) Act was signed into law increasing the withholding rate from 10% to 15% for transactions closing on or after February 17, 2016.

Whew! That’s a lot of acronyms.

THERE ARE SOME EXCEPTIONS TO THE 15% RULE. THOSE ARE…

- If the sales price is $300,000 or less, the buyer intends to occupy the subject property, AND executes a certification of the facts (Buyers Affidavit of Residency, Intent, and Price), the withholding rate is 0%. This exception remains unchanged and was reconfirmed by the PATH Act.

- If the sales price exceeds $300,000 but does not exceed $1,000,000, the buyer intends to occupy the subject property, AND executes a certification of the facts (Buyers Affidavit of Residency, Intent, and Price), the withholding rate is 10%. This exception was newly created by the PATH Act.

For all other transactions the withholding rate is 15%, unless the foreign seller has obtained from the IRS a written Determination of Reduced or Waived Withholding. These determinations take a long, long, long time to obtain. Expect longer than 6 months.

Foreign sellers… if you want all the proceeds at the sale, then begin the process with the IRS early… like a year or so before you want to sell.

CLARIFICATION.

Please don’t misunderstand. I feel like I need to point out what we consider a foreign seller. As far as real estate transactions are concerned, a ‘foreign seller’ is someone who does NOT file taxes in the United States. They could file taxes in Canada. If they don’t have a federal tax identification number, that could be either a social security number (SSN) or an employer identification number (EIN), then I don’t know how they would file a federal tax return. If both pieces are missing, then withhold funds.

PRACTICE POINTER.

Here’s the other piece to keep in mind. People tend to guard their SSNs a little closely. From a business operating standpoint, I don’t need sellers to give me their SSNs personally. I just need to make sure they give it to the escrow company involved on the transaction. Escrow gets to do the dirty work at my direction. They are the ones who will deal with the funds that go back and forth, but it is my job to make sure that happens.

As an agent, I ensure that both parties filled out that silly little escrow affidavit that states who they are and what their intention is with the property. Will or did they live there? Is this an investment? What is their tax ID?

AVOID THE SURPRISE.

Let’s use a real life example and see why you need to take this matter seriously.

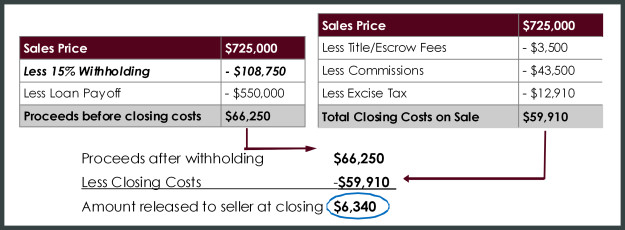

If a property sells for $725,000, but has a loan at closing that needs to be paid of $550,000, the seller would be expecting around $175,000 before closing costs.

Now, look at what happens.

Imagine if you are a seller who thought you were going to get over $100,000 at closing and then instead you get a check for $6,340… how do you think that conversation goes?

Yeah… Not well.

Practice better business. Have the discussion up front so that everyone involved knows what is going on.

Ideally, you can avoid this type of a conversation completely by working with an agent who is on top of their game and watches your back from all sorts of angles… from the liability to the property itself to taxes and so much more.

It is easier to divert trouble in advance by strategizing beyond just the listing or closing date.

MARKET INTELLIGENCE MATTERS.

Need help? That’s what I do. You can find me any day except Sunday.

Jen Hudson

Call/text (206) 293-1005

Awesome information for my closing on a parking spot on Feb 16, 2016. Seller was disclosed as Canadian 19 days after contract and 15 days before closing. It was a cash offer and I didn’t plan on using a lawyer at first. After learning that FIRPTA was going to be a concern, I looked for an affordable lawyer that knew about FIRPTA. It was hard to find an affordable lawyer who wanted to handle the case. I got a discount on the price because the seller didn’t want a delay the closing that was set before the 15% withholding increase. With this discount I was able to hire a good lawyer. Closing is tomorrow.