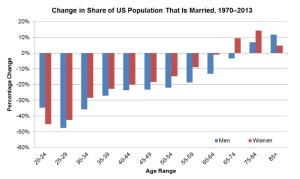

The share of 25-29 year olds who are married is down by almost 48% for men and 43% for women from 1970. That’s HUGE in the rental market… what do I mean?……

I try to read data and trends from a number of sources, all in an attempt to get a better picture of what is really going on in our market. Recently I read an interesting article from John Burns Real Estate Consulting, and wanted to share. I think it supports the trends that we’re seeing from the street level regarding homeownership. Frankly… this is one of the core reasons why I think being a landlord or investor is a great thing in the right location. Here’s the article is below…

The share of 25-29 year olds who are married is down by almost 48% for men and 43% for women from 1970. This single fact is one of the biggest game changers in the housing industry. What do I mean?

The housing market is unquestionably fueled by life stage changes, particularly the change of marital status and the addition (and subtraction) of children. These changes significantly affect where consumers want to live and what kind of property and community they will choose. For example:

- Singles are more likely to rent and live in locations that are closer to entertainment and employment, and these areas are seeing more demand today than they have historically.

- Marriage usually ignites the desire to own a home with a variety of locational and housing choices depending on income and family present.

- Cohabitation has certainly been on the rise in recent decades. Homeownership rates for cohabitating couples are much lower than rates for married couples. (Continued)

- The addition of children makes owning a home almost a necessity, given the need for yards, toys, education, social circles.

- Children moving out often results in lifestyle changes, including different social circles, home size, and floor plan needs. Locational preferences also begin to shift.

The Consumer Insights survey of 22,000+ new home shoppers, coupled with the Housing Demand Model by Lifestage and Price Point, shows just how much housing preferences have changed.

So, is it a good time to buy investment property closer in to town? YES! You bet it is!

If you’re looking for an opportunity to expand your portfolio, or adjust your current property holdings to somewhere closer in for the long term, then give me a call at (206) 293-1005 or send me an email: Jen@HudsonCREG.com. I’d be happy to do a custom analysis for you and see where some of your best opportunities are, given your own goals and what you’re looking for.